FD Capital Research Shows Interest Rate Levels Too High for Too Long and Came Too Late

FD Capital Research Shows Interest Rate Levels Too High for Too Long and Came Too Late

The Bank of England and the UK Government are both seeking to wrestle inflation down to the bank’s 2% target from its record high of 11.1% in October 2022. At FD Capital, we’re publishing our research against the Bank of England’s ‘higher for longer’ strategy, identifying how higher interest rates being implemented 9 to 12 months earlier by a more proactive Bank of England could have avoided a recession.

Inflation rates for November 2023, released before Christmas, showed an unexpected drop in inflation levels across the board, leading to increased calls for the Bank of England to cut interest rates in response. While this interest rate fall came as positive news to UK households, it’s unlikely the Bank of England will be reactive to these results.

FD Capital research concludes that the Bank of England’s interest rates are too high, too late, and have been in place for too long. Several indicators suggest that 2024 will see the UK economy experience a deepening recession with the Bank of England reacting too late to capitalise on falling inflation levels.

Our research echoes calls by investors and commentators that the Bank of England should start loosening its economic policy in early 2024. However, we can expect to see the consequences of the Bank of England’s ill-fated inflation strategy continuing to cause harm to the UK economy for the next 9 to 12 months.

How the UK Economy Stumbled into Inflation

Several factors have attributed to how we’ve ended up in our current economic position. While the Bank of England and the UK government set out to shield the economy and public from the impact of the pandemic, its short-sightedness and overindulgence in ‘bounce back’ schemes resulted in pent-up demand that brought inflationary pressures.

Other major economies, such as the United States, introduced similar policies but have not been faced with the same cost of living crisis as we’re experiencing in the UK.

- COVID Support, Furlough, and Loans

The government’s bounce-back scheme was designed to shield taxpayers from the financial impact of COVID-19, but it didn’t consider the post-COVID implications of such measures.

The global economy has made a slow recovery from the pandemic and the demand from countries like the UK, USA, and EU led to an inflation surge in March 2021 when the UK’s final lockdown ended. This surge led to inflation peaking during the summer of 2022, which we can now point to as a more significant factor than most financial commentaries considered it to be at the time.

- COVID and Ukraine War

Economies have always found themselves at the mercy of geo-politics and the UK economy in recent years is no exception. COVID supply chain issues and the impact of the war in Ukraine have both contributed to inflationary measures but neither have been monumental during the spike of the UK’s inflation surge.

- Slow Interest Rate Rises

Interest rates were raised too slowly during the final stages of the pandemic. These interest rates should have peaked in the summer of 2022, in line with the inflation surge. Instead, they gradually increased at a slower rate until they peaked in summer 2023. By this stage, the inflation surge had fallen off. Interest rates hit 1.25% at their peak but it’s likely significantly lower rates would likely have been a strong enough measure to get inflation under control.

- Bank of England’s ‘Higher for Longer’ Message

The Bank of England has stuck to a ‘higher for longer’ mantra, which now appears to have been largely misguided. Evidence suggests that interest rates should have peaked a year earlier than they did and the ‘higher for longer’ philosophy has led to interest rates being unnecessarily high.

The overly restrictive 5.25% rate would have been more effective as a lower 3.25% peak in summer 2022. The policy of ‘higher from longer’ from summer 2022 to 2023 was too late, starting at the same time it should have finished if it had been implemented the year earlier.

Interest rates have been too high for too long with now appearing to be too late for the Bank of England to take meaningful action to prevent a recession. Interest rate increases take an average of 9 to 24 months to have an impact on the economy. The Bank of England has admitted that only around half of the rate increases in this recent cycle have had an impact on the economy.

FD Capital’s research shows that interest rates have continued rising, even when inflation has rapidly fallen. It’s now too late to stop any further negative economic impact as we’ll only experience the full effect of the final increase within 18 months of its implication.

The continuation of the ‘higher for longer’ policy means that the timing of rate rises has been incorrect, coming too late after the pandemic and being too high.

UK vs. The Rest of the World

There is a growing criticism among the public around the UK economy evidentially suffering worse than its major counterparts.

The USA and EU both experienced similar inflation peaks and steepness and engaged in quantitative easing and COVID support schemes. By comparison, China and India did not take either of these measures and have a lower inflation rate. China’s peaked at 2.1%, while India’s peaked at 7.5%.

While the UK government’s lockdown support schemes were designed to shield the population from the economic impact of COVID-19, they had the opposite impact by creating pent-up demand that supply chains could not meet due to the pandemic. International trade took significantly longer to recover post-lockdown as a result of this demand. This situation created the classic ‘supply and demand’ equation that has resulted in the inflation we’re experiencing today.

While it’s correct that interest rates should have been held higher for longer, the peak should have been during the summer of 2022 at a level of around 3%. If this action had been taken then, the rates would now be slowly falling again.

What we’re experiencing now is the Bank of England continuing to be out of step with the economic reality with its recent cycle of interest rate rises. These actions continue to compound the Bank of England’s mistakes, showing them moving too late, too slowly, and now setting the rates too high for too long.

Is the UK Heading for a Recession?

2024 is already full of speculation on the potential of a recession in the UK. With a General Election on the horizon, we can expect to see more of this speculation in the coming months as political parties attempt to draw together an economic policy to avoid a recession and restart the economy.

Several indicators suggest a recession is likely in 2024, including the ‘Sahm Rule’ and M0 monetary indicators.

Sahm Rule Recession Indicator

The ‘Sahm Rule’ identifies the economic signals that suggest the start of a recession is underway. These signs include when the three-month moving average for the national unemployment rate rises by 0.5% or more in comparison to the previous twelve months.

The ‘Sahm Rule’ uses real-time data monthly to determine the likelihood of a recession. It has been used to correctly call every recession in the United States since 1960 with no false positives. Investors in the United States are appearing hopeful that its current indicator is incorrect, but the same cannot be said in the UK – largely as a result of the Bank of England’s actions.

M0 monetary indicators also support the ‘Sahm Rule’ in suggesting that a deepening recession is on the horizon in 2024.

The Impact of UK Households

We’re all now familiar with the term ‘cost of living crisis’. Most of us are feeling the pinch more than ever. Taxpayers and corporations are now dealing with the financial impact and consequences of the untargeted nature of the Government support measures put in place during the lockdown.

Base rates are already sitting too high for an economy that has been comfortably enjoying almost zero rates for the last decade before the pandemic. The impact of this will become more apparent and widely felt in the first three quarters of 2024 as the headline RPI continues to drop, while real interest rates rise to excessive levels.

FD Capital’s Research on the Future of the UK Economy

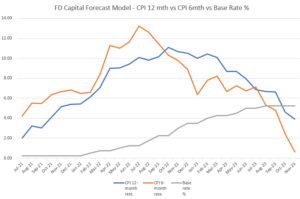

Our forecasting model suggests that the inflation CPI 12-month rate will fall to 2.2% by March 2024. This time frame should also see the 6-month CPI rate hovering in the region of 1% for the next 6-month period. It will likely rise in January and February before seeing a fall again. It will fall below target from March 2024 onwards, but interest rates will start undershooting if they remain too high.

FD Capital’s research supports the argument that interest rate increases should have started at least 9 to 12 months earlier than they did with quantitative tightening happening 18 months earlier. Evidence suggests that interest rates should have peaked in April or May 2022, being held high until the end of summer 2023 before being reduced as the economy moves beyond its inflationary interval.

The Bank of England’s delay in bringing in measures and putting interest rates too high for too long means that the UK public is now left paying the price. It’s a price that will only increase as the UK braces itself for a deep recession as a result of the economic decision-making by the UK government and the Bank of England in the immediate wake and aftermath of the pandemic.

Where is the UK Economy in 2024?

Where is the UK Economy in 2024?

2024 is the year that the UK economy is bracing itself for a recession. There was some positive news before the Christmas break with a higher-than-expected drop in the UK’s inflation levels.

Unexpected Inflation Drop Reported in December 2023

UK Inflation fell to 3.9% in November from 4.6% in October with a drop that surprised economists, who are now pricing in a Bank of England interest rate cut happening in May. It beats the modest decline that economists had been expecting of 4.4%. This surprise drop puts the UK’s inflation level at its lowest rate in two years with this change being largely attributed to cheaper petrol prices, which have hit their lowest cost since September 2021.

The headline CPI inflation reading was also below that forecasted with core and services measures of inflation also dropping. Investors are appearing to predict a 50% chance of an interest rate cut by March with one seemingly guaranteed by May. This growing speculation resulted in a fall in bond yields.

While forecasters are saying that these recent figures suggest the need for a rethink, the Bank of England is continuing to remain cautious. The Chancellor, Jeremy Hunt, welcomed the inflation drop saying that it shows inflationary pressures are being removed from the economy. Core inflation also fell to 5.1% from 5.7%, while services inflation fell to 6.3% from 6.6%.

It’ll be difficult for the Bank of England to ignore the noise surrounding these figures as calls continue to grow for meaningful inflation cuts. The Bank of England maintains its main interest rate at 5.25% the week before the inflation rate drop with the Monetary Policy Committee stating that it is likely to “be restrictive for an extended period of time”. September saw the end of 14 consecutive interest rate heights by the Bank of England.

UK No Longer Alone In Its Inflationary Economy

The UK is no longer an outlier amongst major economies following this inflation rate drop. Its headline inflation rate now matches that of France. However, the rise of almost 21% in consumer prices since 2020 is the joint-highest increase in Western Europe and more than any other advanced economy in the G7.

Recession in 2024?

The UK’s economic position in a wider global context shows the impact of the Bank of England’s ‘too late and too high for too long’ policy in response to inflation. We remain critical of the Bank of England’s strategy and support calls for an interest rate decrease in the first quarter of 2024.

The UK remains on a knife edge as to whether it will fall into a deep recession in 2024. Experts continue to warn that this year will be another characterised largely by stagnation in the economy if it narrowly manages to miss a recession. This situation could have been avoided with proactive steps by the Bank of England in 2022, as highlighted by our research.

Explore more of our research and commentary by visiting the FD Capital blog.

Related posts:

Adrian Lawrence FCA with over 25 years of experience as a finance leader and a Chartered Accountant, BSc graduate from Queen Mary College, University of London.

I help my clients achieve their growth and success goals by delivering value and results in areas such as Financial Modelling, Finance Raising, M&A, Due Diligence, cash flow management, and reporting. I am passionate about supporting SMEs and entrepreneurs with reliable and professional Chief Financial Officer or Finance Director services.